BOTTOM LINE: Last Friday's low did indeed turn out to be a low of some kind. Whether this low holds for a few weeks remains to be seen. For now, provided this Monday's lows hold, I consider the likelihood of a multi-week rally to be very high.

For all my bullishness, I am very careful at these pivotal levels. Should markets show weakness, particularly below levels we saw only yesterday, I would shift to a neutral stance.

Below is a four-hourly chart of the German DAX. In the next few weeks, this index could rally all the way to 5800.

This is the Straits Times index from Singapore. A very clear impulse can be seen from the highs. It is likely that some time and further price appreciation will be needed to clear the oversold condition.

This is an hourly chart of the Australian ASX index. Being a highly sensitive economy to the global growth cycle, Australia merits particular attention. The charts are extremely clear for this index, and suggest a strong rebound.

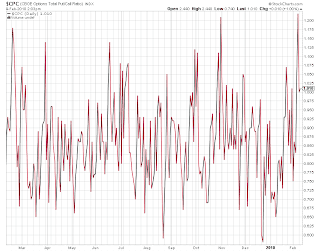

Stocks remain deeply oversold on a number of metrics, one of which is the number of stocks trading above their 50 day moving averages. As can be seen from the chart below, stocks are now more oversold than at the ends of two major corrections to the March'09-January'10 rally. While this and other breadth indicators could fall further, I consider the possibility remote.

No comments:

Post a Comment