Monday 13 December 2010

Nosebleed

Tuesday 16 November 2010

Wave Three Down?

Monday 15 November 2010

Air-pocket?

Friday 12 November 2010

Boom, Boom, Pow...?

Wednesday 10 November 2010

Get Ready to Rock!

Thursday 28 October 2010

Pushing on a String

Monday 25 October 2010

Tops in Equity Markets

Tuesday 19 October 2010

Higher, for Longer

Thursday 30 September 2010

The Canary In The Coalmine...

Tuesday 21 September 2010

The Time Is Now II

Monday 20 September 2010

The Time Is Now

Wednesday 1 September 2010

Monday 23 August 2010

Asset Markets To Rally

Tuesday 27 July 2010

Strength In Asset Markets Likely Over Soon

Monday 5 July 2010

Very Oversold, But Still Room To Go

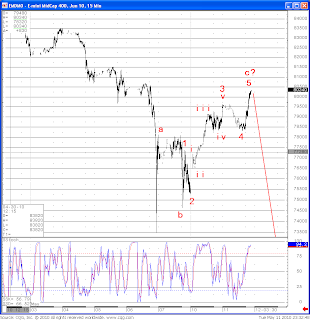

More downside?

So far, the larger “irregular” count I have been following is working out well.

Again, so far, we had a very neat impulse lower in the EZ banking sector. Surprisingly, Spanish and French banks have been noticeably stronger than, say, German or Skandi banks.

That notwithstanding, they have also, on hourly charts, traded beautiful little corrections (abc in lower case on the chart).

This is quite a count… if it is correct, the market will collapse in the next 3-4 sessions.

I expect a bottom to hit around mid-next week.

This is an hourly chart of the Spanish bank Santander:

Monday 21 June 2010

Fireworks, Fireworks, Fireworks.

I am now on full alert for rapid declines in risk and related assets.

As suggested in my previous post and pointed at in the accompanying charts, risk and related assets have likely peaked from slightly higher levels from Thursday last week.

I believe that today’s (post Chinese announcement) highs might turn out to be fairly secure stop loss levels for short-risk trades.

It is likely that there will be some form of a retracement (a move higher) in the next 24 hours.

No charts today.

Thursday 17 June 2010

Fireworks Alert!

Wednesday 9 June 2010

Friday 28 May 2010

Market is likely to break lower from current levels

Friday 21 May 2010

Kiss of Death?

Wednesday 19 May 2010

Crossroads

Thursday 13 May 2010

Correction Higher Is Likely Over

The entire advance from the "flash crash" low appears to be taking shape of a zig-zag, with several hallmarks that define such structures: a) very sharp movements; b) wave "a" and "c" equality; c) diminishing volume relative to the impulsive move that preceeded it; d) retracement of the "extension".

It is therefore my belief that global equity markets are about to take the turn for the worse imminently (within the next 2-3 trading sessions).

Tuesday 11 May 2010

Corrections Higher Likely Finished

Monday 10 May 2010

Fool's Gold - Sell This EU Spike

Major European and US averages traced out beautiful corrective zig-zags to the upside. Similarly, the time-old market indicator - Copper is also quite weak today, and is likely finishing its correction higher.

Finally, Asian indices have not at all participated in this rally, even though they fell a fair bit in line with Europe.

In short, go SHORT.

Thursday 6 May 2010

Correction Underway

Friday 23 April 2010

The Fun Ought To Continue Soon

Thursday 15 April 2010

The Fun Ought To Begin Soon

From wave analysis:

Emerging Markets moved to new highs (as forecasted all the way back in February 2010) in what appears to be a finished impulse:

From other indicators:

Relative to historic norms, the market is under pricing near-term (1 month) volatility relative to medium-term (3 month) volatility, as shown by the blue line in the chart below (ratio of VIX to VXV).

Relative to historic norms, the market is under pricing near-term (1 month) volatility relative to medium-term (3 month) volatility, as shown by the blue line in the chart below (ratio of VIX to VXV).

It is often said (past couple of months) that the market’s internals are very strong, as shown by the ever rising cumulative advancing-declining issues count, shown below. It also true that major tops during the XX century have all been accompanied by deterioration in breadth. This does not rule out a decline of about 10-15% now, followed by an advance, by most US averages to new highs, this time not accompanied by a rally to new highs by the AD line. This is how the top formed in 2007.

Finally, the McClellan oscillator has shown negative divergences prior to all market tops. It is doing so now:

Finally, the McClellan oscillator has shown negative divergences prior to all market tops. It is doing so now:

Monday 5 April 2010

The End-Game

Here on the daily SP500 chart, both the RSI and Stochastics are extremely oversold. The index is alos sliding along the lower Bollinger band. I expect a move lower short-term, followed by a multi-week bounce, as shown by red lines.

Here on the daily SP500 chart, both the RSI and Stochastics are extremely oversold. The index is alos sliding along the lower Bollinger band. I expect a move lower short-term, followed by a multi-week bounce, as shown by red lines.