The outlook right now is less clear than it has been for the past six weeks. I do not think that the decline from January to February has been corrected, and therefore expect more "thrusts" higher. At the same time, I expect those "thrusts" from a lower base, perhaps from around the levels of the February low.

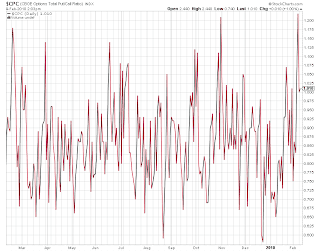

Below is a four-hourly chart of the Nasdaq100. I think it could easily drop to February lows (-5%), and then rally back to the highs of this week to complete the correction. In October/November 2007, this very index travelled up and down around 5.5% in 11 trading days (second chart, below). At the time, the VIX was trading around 20%, same value as today.

In short, I cannot see prices breaking down into a waterfall decline before more corrective action is seen.

Nasdaq100, four-hourly